The Challenges To Navigate In 2015

Issue 0030

There are certainly many challenges confronting business operators in 2015. This article discusses a few of them.

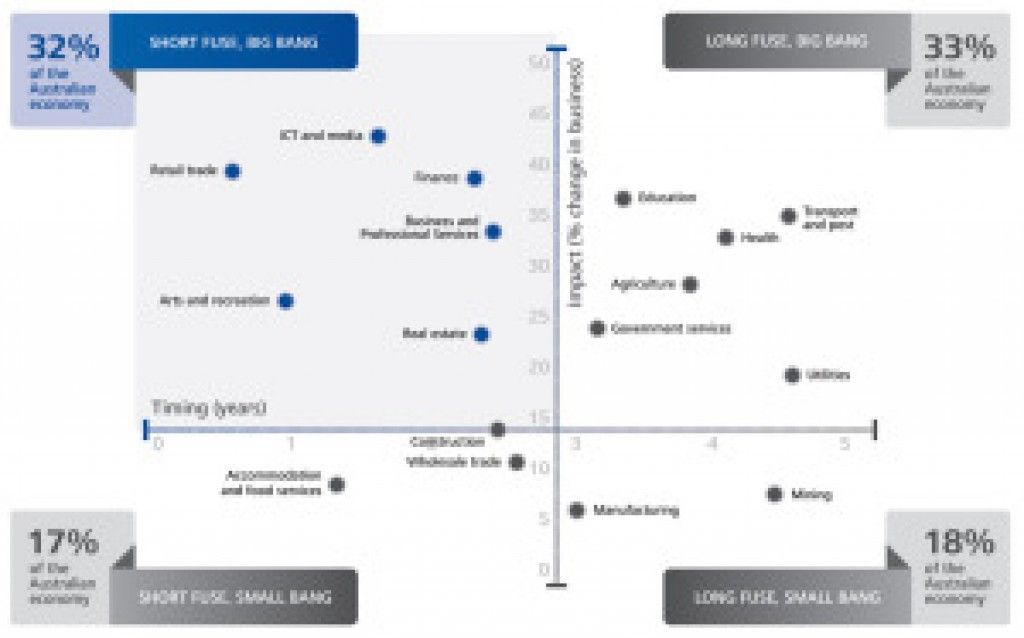

Digital Disruption

A couple of years ago, Deloitte produced a report, “Digital disruption – short-fuse, big bang?” This report predicted that six different industry groups, comprising:

- retail trade;

- arts and recreation;

- ICT and media;

- finance;

- professional services; and

- real estate,

will encounter 24 to 43% of revenue becoming “disrupted” over time.

“Disruption” doesn’t mean revenue is gone. However, there will need to be new strategies developed by the affected industries on how to respond to changing market conditions. One of the key recommendations by Deloitte is that businesses should “replenish revenue streams”.

Australian Economy

The Reserve Bank has not set interest rates at 2.25% to assist borrowers. These historically very low interest rates are indicative of an economy that has significant problems. There are depressed business situations in some areas around Australia, primarily caused through significant reductions in activities in mining industries and the flow-on effects to other allied businesses. This leads to businesses closing or making significant staff retrenchments, which affects virtually any business in the local environment.

Personal Property Securities Act

The Personal Property Securities Act (PPSA) is causing ongoing problems for many businesses, both small and large, mainly caused through business people not having an understanding of the requirements of the legislation.

Turbulence in Politics

It’s interesting to look at what’s happened in politics in Australia in the last 18 months. At the end of January 2015, a government which, three years ago, received an overwhelming mandate in Queensland, was defeated in the election. Late last year in Victoria, a first term government was rejected in favour of the opposition. These election results highlight that the electorate has become tougher to please. This probably means that, if you can’t receive the type of services you require from your various advisers, that you will probably consider seeking these services from another supplier.

Business services that are available

There is a wide range of business services that are available for small/medium enterprise operators from accountants/advisers. Many of these services have been identified in various surveys of small business operators conducted over the last few years. The services include:

- management of costs

- management monitoring

- business plans

- assistance in raising capital or loan funds

- expansion advice

- future planning

- budget analysis and interpretation

- investments

- tax planning

- raising finance

- succession or exit planning

- information technology

- record keeping

Other areas on which you will need to keep a close eye and possibly seek advice from accountants/advisers during 2015 include:

Debtors’ Management Advice

Debtors’ days outstanding is currently 51.6 days. Whilst this is an improvement of the 54 days that applied in the previous quarter, it’s still three weeks longer than the standard business trading period of 30 days. If your debtors are sitting on 51 days and your turnover is $2million, all on credit sales, this will mean your debtors’ ledger is at $282,739.00. If your debtors are trading within the normal 30-day trading term, the debtors’ balance would be $164,383 – a cashflow improvement of $118,356. Your accountant/adviser should be able to assist you to implement strategies to reduce debtors’ days outstanding. It’s far better for you to have the $118,356 in your bank account than have it owing to you by your customers.

Shrinkage/Waste Management Advice

Shrinkage is a huge problem for many businesses. Shrinkage can be caused by:

- damage;

- theft by an employee;

- theft by a customer;

- errors in recording label numbers;

- not adequately checking goods when they’re received into the business;

- poor handling techniques;

- dropping stock;

- leaving perishable products out of refrigeration;

- over-ordering products, thus having products that need to be discounted to sell; and

- stock going out of date – this can be caused by poor stock rotation.

PPSR Due Diligence Review

Our recommendation is that every business should be requesting their accountant/adviser to conduct a Personal Property Securities Register (PPSR) due diligence review, to ensure the business has implemented appropriate systems to safeguard your business assets under the Personal Property Securities Act (PPSA). There’s a lot of confusion relative to this legislation. The title “personal property” is confusing enough. This legislation doesn’t apply to your “personal property”, rather to your business property. Why the legislation is not called “business property” we don’t know, nevertheless, it has caused a lot of confusion. There can be disastrous effects for a business operator, caused through ignorance of the way this legislation operates. A business that has paid for an asset can effectively lose that asset if the business has not registered the asset or transaction on the PPSR. It doesn’t seem right, however, that’s how the legislation works and it’s for that reason that we are strongly recommending that every business has their accountants/advisers conduct a due diligence review of the systems that have been implemented and to continually monitor the potential exposure the business has through the effects of the PPSA.

Government Grants

If you want to invigorate your business, one way of doing it can be to successfully apply for a government grant. There are many Federal, State and Territory government grants available for small/medium enterprises. The recent grants issued by the Federal government are targeted at what the government is referring to as “priority industries”. The “priority industries” include hundreds of industries under the general definition:

- Advanced Manufacturing

- Mining Equipment, Technology and Services

- Oil, Gas and Energy Resources

- Medical Technologies and Pharmaceuticals

- Food and Agribusiness

- As well as “enabling technology and service industries” that support one or more of these priority industries, including:

- Freight and Logistics

- Infrastructure Related Construction

- Information and Communication Technology

- Professional Services (in a limited way)

If you are operating a business that might fall under the definition of “priority industries”, it will be worthwhile to make an enquiry relative to the possibility of obtaining a government grant.

Accountants can assist

Accountants can assist businesses navigate the challenges 2015 is presenting. As a preview to the type of services an accountant/adviser, utilising services made available by ESS BIZTOOLS, a complimentary copy of ‘Debtors’ Management System – Introduction Checklist’ can be downloaded with this transcript. If you are interested in any of the work discussed in this article being undertaken, we urge you to have a discussion with your accountant. However, if your accountant is unable to provide you with this type of service, please don’t hesitate to send an email to peter@essbiztools.com.au, with your location and postcode, and we will send you an introduction to an accountant/adviser whom we know will be able to deliver this service for you. If you wish to receive future editions of Survival Hints for Small Business series, you can visit our iTunes – Podcasts - Survival Hints for Small Business page and subscribe to our podcasts. If you have any questions or suggestions on future items to be covered in Survival Hints for Small Business, please don’t hesitate to contact us.

Past Posts

-

Innovation is Important for SMEs

Innovation is Important for SMEs -

6 Steps to Boost Your Productivity and Profits

6 Steps to Boost Your Productivity and Profits -

Tax Incentives For Early Stage Investors

Tax Incentives For Early Stage Investors -

ESIC Targets SMEs, Inventors, Young Companies

ESIC Targets SMEs, Inventors, Young Companies -

Early Stage Innovation Company Investor Opportunities

Early Stage Innovation Company Investor Opportunities -

Will You Have an ESIC Story?

Will You Have an ESIC Story? -

Are you Receiving a CFO Service from your Accountants?

Are you Receiving a CFO Service from your Accountants? -

Succession Planning

Succession Planning -

Business Plans

Business Plans -

The Year for Business Advisory Services!

The Year for Business Advisory Services! -

Are you Aware of the PPSR?

Are you Aware of the PPSR? -

SME Operators – Accountants can Help you with Debtors’ Ma...

SME Operators – Accountants can Help you with Debtors’ Ma... -

Happy New Financial Year

Happy New Financial Year -

The Finalisation of the ESIC Legislation will be a Great ...

The Finalisation of the ESIC Legislation will be a Great ... -

A Business Evaluation Review Can Assist You

A Business Evaluation Review Can Assist You -

June is a Great Time to Prepare a Business Plan

June is a Great Time to Prepare a Business Plan -

Businesses Need a Broad Succession Strategy

Businesses Need a Broad Succession Strategy -

Innovation Companies are a Great Opportunity for SMEs

Innovation Companies are a Great Opportunity for SMEs -

The PPSR – are you aware of it and how it can affect your...

The PPSR – are you aware of it and how it can affect your... -

Debtors Management - Vital for Business Success

Debtors Management - Vital for Business Success -

How can your Accountant assist you?

How can your Accountant assist you? -

The Personal Property Securities Register – how do you pr...

The Personal Property Securities Register – how do you pr... -

Legal Advice is Essential for Business Success

Legal Advice is Essential for Business Success -

Is your accountant your trusted adviser

Is your accountant your trusted adviser -

Is your accountant famous for adding value?

Is your accountant famous for adding value? -

Portfolio Allocations Are Important For Effective Management

Portfolio Allocations Are Important For Effective Management -

The Challenges To Navigate In 2015

The Challenges To Navigate In 2015 -

Business Plans Are Important For All Businesses

Business Plans Are Important For All Businesses -

Entrepreneurs’ Infrastructure Program

Entrepreneurs’ Infrastructure Program -

Digital Disruption Is A Major Concern

Digital Disruption Is A Major Concern -

Court Case Decisions on the Personal Property Securities ...

Court Case Decisions on the Personal Property Securities ... -

Personal Property Securities Act Presents Businesses A "T...

Personal Property Securities Act Presents Businesses A "T... -

Do You Require Additional Financial Services?

Do You Require Additional Financial Services? -

Personal Property Securities Act – How Does It Affect Sma...

Personal Property Securities Act – How Does It Affect Sma... -

Business Health Checks For Your Business

Business Health Checks For Your Business -

Why Do Some Accountants Offer Chief Financial Officer Ser...

Why Do Some Accountants Offer Chief Financial Officer Ser... -

Getting Assistance From Your Accountant To Better Manage ...

Getting Assistance From Your Accountant To Better Manage ... -

Identifying The Services You Want To Receive From Your Ac...

Identifying The Services You Want To Receive From Your Ac... -

What Is Business Advisory Services?

What Is Business Advisory Services? -

Accountants Can Offer More Services Than Just Tax Returns

Accountants Can Offer More Services Than Just Tax Returns -

Being Kept In The Loop By Your Accountant

Being Kept In The Loop By Your Accountant -

Personal Property Securities Register – Have You Develope...

Personal Property Securities Register – Have You Develope... -

Reducing Debtors' Days Outstanding

Reducing Debtors' Days Outstanding -

Management of Costs - An Overview

Management of Costs - An Overview -

Succession Planning - Why Is It Necessary?

Succession Planning - Why Is It Necessary? -

Safe Guarding your Business under the Personal Property S...

Safe Guarding your Business under the Personal Property S...